Risk Management

Risk Layering

CDRFI Instruments

Key benefits of CDRFI

Instruments and projects tailored to the risks

The V20/G7 Global Shield will facilitate Climate and Disaster Risk Finance and Insurance (CDRFI) instruments to help vulnerable countries close protection gaps. This will be enabled through an In-Country Process, which fosters sustainable and inclusive CDRFI capacities within the country. Integrated into comprehensive climate and disaster risk management, CDRFI can help countries, businesses, and people recover quicker and better when disasters occur. A wide range of financial risk retention and transfer instruments and projects enhances the volume of pre-arranged finance as well as the reliability and timeliness of payouts. The array of instruments builds on different actors’ expertise and institutional capabilities, including those of the private sector.

Comprehensive Climate and Disaster Risk Management

The key value of risk financing and insurance is to absorb residual risks that cannot be mitigated cost-effectively through other risk management measures. Furthermore, having pre-arranged risk financing on standby allows for an earlier and more reliable response to disasters. Governments can avoid reallocating scarce resources or borrowing on poor terms following a disaster.

In a comprehensive risk management approach, risk modelling serves to identify cost-effective risk prevention and reduction options and their trade-offs, up until the point at which they become unaffordable and risk financing proves practical. Building on that, risk finance instruments can then be identified and combined using a risk layering approach. Ultimately, this helps to identify those combinations of risk-management measures that come with the lowest overall costs while maximizing resilience.

The Global Shield will seek maximum alignment of CDRFI with broader climate change adaptation and Disaster Risk Reduction (DRR) strategies.

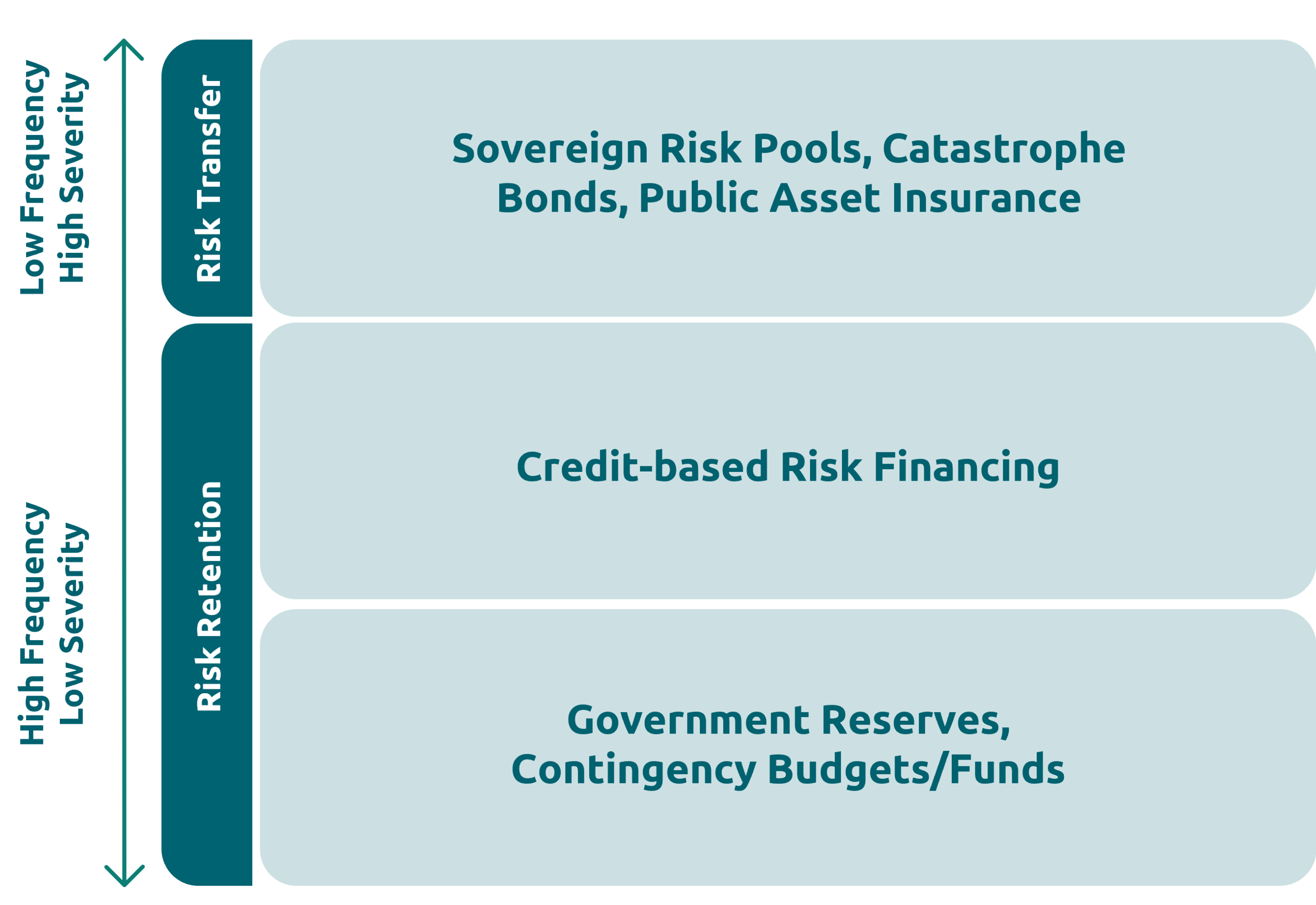

Risk Layering

Extreme events and disasters of different frequency and severity require different risk management strategies and CDRFI instruments. In a risk-layered CDRFI strategy, adequate and cost-effective instruments are arranged across the respective layers of risk.

In practical terms, this implies that under a risk-layered approach, insurance would not have to pay out for a less severe event because it would be covered by liquidity from a budget reserve. Whereas in the case of a very severe event, instruments from all layers would be used complementarity to cover the losses.

Overview of CDRFI instruments

Based on country-specific needs, the Global Shield will be able to support:

i) CDRFI instruments designed to provide rapid financial assistance to households and businesses to act early against and respond to climate and disaster-related losses.

ii) Pre-arranged finance for governments, humanitarian agencies, and international and local non-governmental organisations (NGOs) for disaster preparedness and rapid response.

Micro, meso and macro level instruments

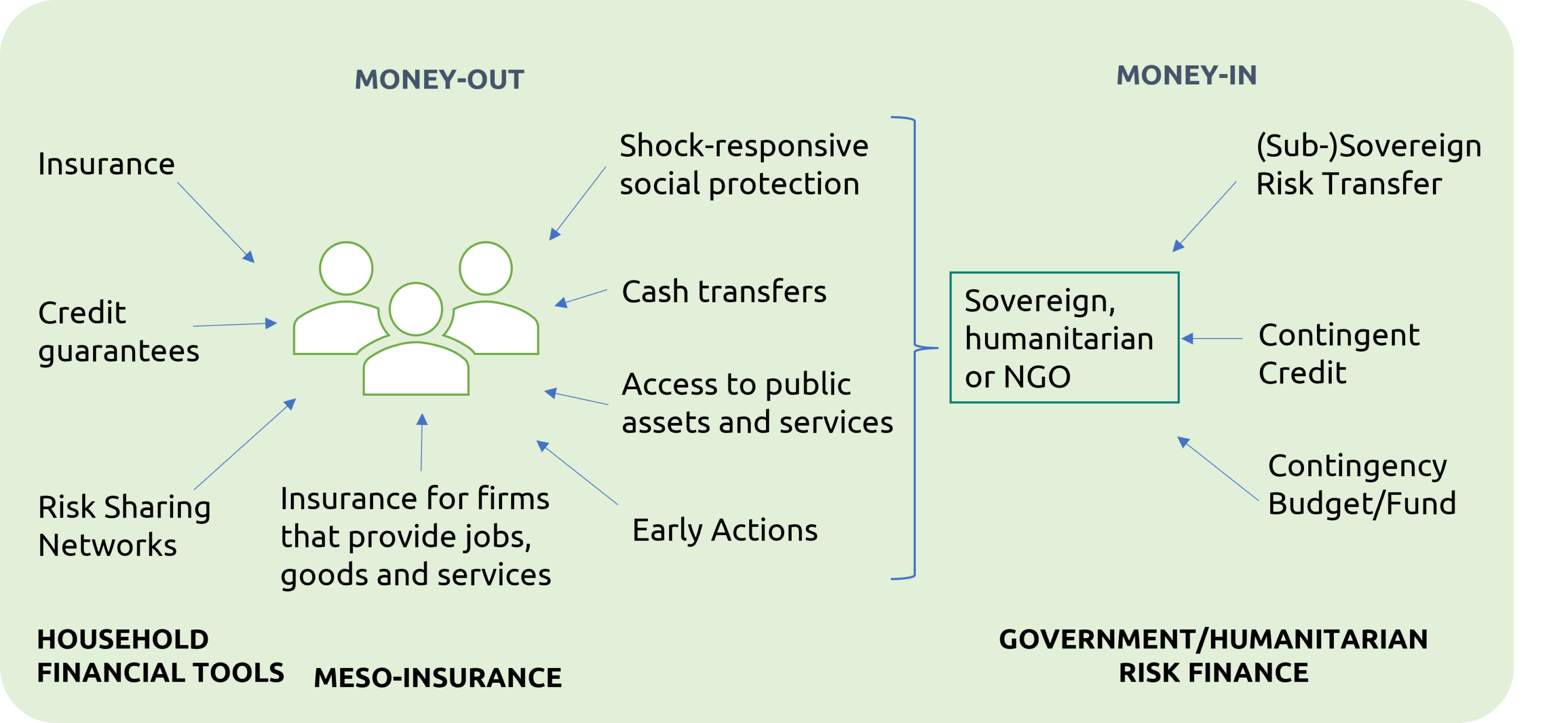

At the household and business level (meso and micro), these instruments comprise livelihood protection, social protection systems, livestock and crop insurance, property insurance, business interruption insurance, risk-sharing networks, and credit guarantees.

At the level of (national and subnational) governments, humanitarian agencies and Civil Society Organisations (macro), the Global Shield will support the integrated development of instruments used to ensure that money is available when needed (money-in), and the processes to ensure that the money is spent on providing what affected individuals and communities need when they need it most (money-out).

Regional Risk Pools

The Global Shield recognizes the important role that regional risks pools play in developing and offering innovative insurance products for national governments. As such, the regional risk pools will be part of the In-Country Processes in order to ensure that governments have a thorough understanding of the types of products that have been developed by the risk pools and the possible benefits and opportunities that these products offer. The regional risks pools offer immense expertise on climate risks and natural hazards that affect their country members and are thus key partners in the Global Shield process.

Money-in and Money-out

Money-in: risk transfer products (e.g. insurance via regional risk pools and development insurers), contingent credit and grant mechanisms, contingency funds, pre-arranged finance (incl. forecast-based), or financial market instruments such as catastrophe bonds, etc.

Money-out: shock-responsive social protection, early and anticipatory action protocols, contin-gency plans (incl. for restoring critical infrastructure), cash transfers, etc.

Key benefits of CDRFI

The combination of financial tools, from microinsurance to sovereign risk transfer, credits instruments, and risk retention strategies provides: